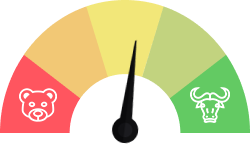

Rivian Automotive (RIVN: NSD) has proposed issuing $15 billion in imaginary municipal bonds for its forthcoming Georgia campus to secure substantial tax incentives. While this is considered an unusual move, it’s not the first time a corporation has used it to its advantage. In a similar move, Amazon issued municipal bonds worth $2.8 billion in 2019 to receive tax breaks for its new headquarters in Arlington, Virginia.

Rivian’s Innovative Tax Strategies:

Rivian’s proposed bond issue would be the largest-ever recorded sale of municipal bonds, dwarfing its current market capitalization. However, the catch is that these bonds don’t exist and serve as a financial gimmick to secure tax benefits. The State of Georgia allows companies to claim tax credits linked to the potential future value of municipal bonds issued for economic development projects. Rivian intends to lock in significant tax savings by issuing these imaginary bonds over the long term.

While the strategy of issuing fictitious bonds may appear unconventional, there is a precedent, and some observers have applauded the company’s ingenuity in navigating complex tax regulations. Nonetheless, financial experts remain divided, with some concerned about potential abuse and the future implications for the municipal bond market.

The bold proposal highlights the lengths that corporations are willing to go to secure tax breaks and underscores the need for transparency and clear guidelines in tax policies to prevent abuse and misuse of incentives.

Amazon also employed a comparable strategy in 2019 to secure tax incentives by issuing $2.8 billion in municipal bonds that were later bought back, ultimately generating tax credits for the e-commerce giant.

Conclusion:

Rivian’s bold move has sparked a debate among financial experts and underscores the role of transparency and clear guidelines in tax policies to prevent abuse and misuse of incentives. While Rivian’s strategy of issuing imaginary bonds is considered unconventional, it has set a precedent for corporations aiming to secure long-term tax benefits.